monterey county property tax due dates

Monterey sets tax rates all within the states statutory guidelines. You can pay online via the Delaware government website.

The California Transfer Tax Who Pays What In Monterey County

The State of Colorado allows property taxes to be paid either in two equal installments or in full by the dates shown below.

. 2020 taxes are payable without interest through January 5 2021. An interest charge of 2 will be assessed on 2020 delinquent property tax bills on January 6 2021. State law says local tax collectors cannot extend the date.

Just find your county and follow the given instructions. Property Tax Refund data for Real Property Homesteads are due. Taxes on unsecured roll are due on the lien date.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. The tax lien or assessment date each year is January 1 st. The papers you require and the procedures youll comply with are found at the county tax office or online.

On April 12 2021. Due date for filing Business Property Statements Apartment House Property Statements Mining and Quarrying Productions Reports etc. First installment of secured property taxes payment deadline.

Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomonterey. May 7 Last Day to file business property statement without penalty July 1. Last day to file application for Green Acres for the current assessment year.

Property tax dates in DC are March 31 for the first and September 15 for the second instalment. A 10 penalty is added if not paid before 500 pm January 1. Lien Date - 1201 am.

Last day to file application for class 2c Managed Forest Land for the current assessment year. Salinas or checks can be dropped off at the City Finance Offices in Carmel Seaside and King City. The SECOND INSTALLMENT payment for annual property taxes was due on February 1 2021 and will become delinquent if not paid by 500 pm.

The present-day market value of real estate located within Monterey is calculated by county assessors. April 10 Last day to pay 2nd installment of property taxes without penalty. Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm.

February 28 June 15. Payments may be made using Visa MasterCard Discover American Express or through an electronic checking or savings debit. On January 1 preceding the fiscal year for which property taxes are collected.

Last day to file application for Rural Preserve for the current assessment year. Payment Due Dates for 2022 Two half payments. If you have not received your tax bill please verify your information is up-to-date with the Supervisor of Assessments at 217-384-3760.

On or before November 1. 2020 taxes are payable without interest through January 5 2021. Checks should be made payable to.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. This due date is set by the Assessor and may vary. Taxpayers who do not pay property taxes by the due date receive a penalty.

Payments may be made by e-check or credit card via telephone 800-491-8003 or by visiting wwwcomontereycaustaxcollector. Delinquent date stated on bill. No discounts for early payment.

The county is responsible for computing the tax value of your property and that is where you will submit your protest. You will receive a statement with upcoming due dates in the Spring. Payments may also be made in person at the county tax collectors office 168 W Alisal St.

If you have not received your tax bill please verify your information is up-to-date with the Supervisor of Assessments at 217-384-3760. The First States tax due date is September 30. Affects the upcoming fiscal year January 31.

Current property tax due dates are. Second installment real property taxes due and payable. Property tax payments are made to your county treasurer.

Monterey County property taxes still due on Friday. Taxes are due and payable September 1 st. Monterey County Property Tax Due Dates.

For contact information visit. An interest charge of 2 is assessed on 2020 delinquent property tax bills on January 6 2021. Property taxes are due when the Treasurer has certified them.

August 31 - Unsecured deadline. You can protest your countys assessment of your propertys tax value if you think it is greater than it should be. Property Tax Due Dates.

First installment of secured property taxes is due and payable. Taxes are due and payable September 1st. Property taxes are due twice a year.

The time when the taxes become a lien on property and the time property is valued for tax purposes. The median property tax also known as real estate tax in Monterey County is based on a median home value of and a median effective property tax rate of 051 of property value. ANNUAL REAL ESTATE PERSONAL PROPERTY AND POLICE SERVICE DISTRICT TAX.

First half of real estate taxes are scheduled to be due Friday February 18 2022 in the Treasurers Office. Postmark accepted for tax payments mailed to our office except tax lien redemptions. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

Search for your current Monterey County property tax statements and pay them online using this service. Second-half real estate taxes are scheduled to be due Friday July 15 2022. Of the fifty-eight counties in.

Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Publish notice of dates when taxes due and delinquent. An interest charge of three-fourths of one percent 34 is assessed on February 1st and each month thereafter until the taxes are paid in full.

Tax bills were mailed April 30 2021 and the first payment is due June 1 2021. 1 days ago If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due. Must be renewed annually between December 1st and January 31st.

As will be covered later appraising property billing and collecting payments performing compliance measures and resolving discord are all left to the county.

Information Technology Department Monterey County Ca

At A Glance Monterey County Monterey County Ca

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Calfresh Monterey County 2022 Guide California Food Stamps Help

District Attorney Monterey County Ca

Monterey County California Fha Va And Usda Loan Information

Monterey County Regional Fire District

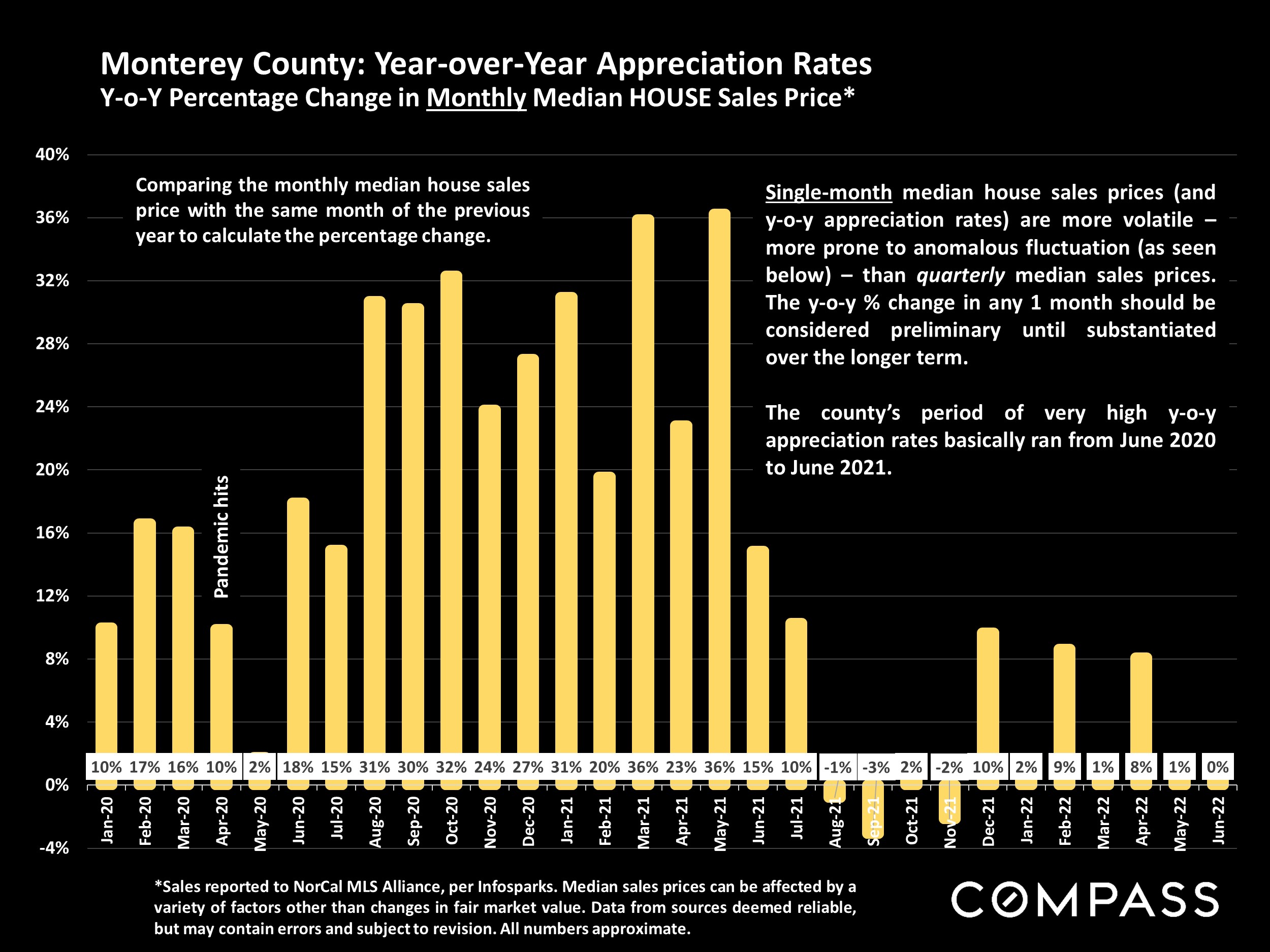

Monterey County Home Prices Market Trends Compass

Monterey County Home Prices Market Trends Compass

Gis Mapping Data Monterey County Ca

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Monterey County Ca Property Data Real Estate Comps Statistics Reports

Mary A Zeeb Treasurer Tax Collector California State Association Of Counties

2022 Best Places To Buy A House In Monterey County Ca Niche

Monterey County Calif Bans Flavored Tobacco Sales Halfwheel

Monterey County Black Caucus Facebook

At A Glance Monterey County Monterey County Ca

A Message From Monterey County S Treasurer Tax Collector The Deadline For Second Installment Of Property Tax Is April 10th Monterey County Mdash Nextdoor Nextdoor